Cars

A Month With Progressive’s Snapshot Device

Last month, I decided to test out Progressive’s Snapshot device in hopes of saving money on my car insurance. The Snapshot device plugged into my car’s OBD2 port and monitored my driving habits over the course of a month. “Good drivers” get rewarded with up to 30% extra savings on their car insurance!

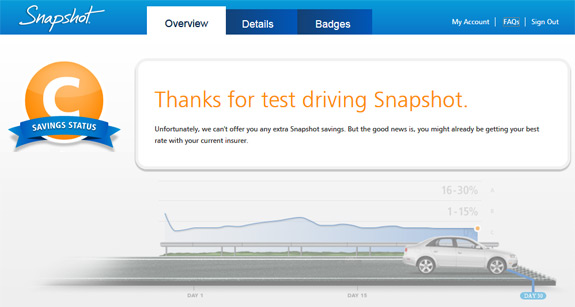

Unfortunately, Progressive doesn’t like the way I drive. 😀

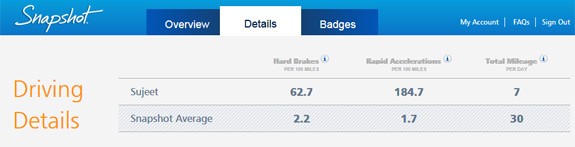

The Snapshot device monitors things such as hard braking, rapid acceleration, miles driven, and the time of day. Based on those statistics, they determine your risk factor. My biggest issue, as you can see in the screenshot below, is that I drive too aggressively..

Why? Because race car!

If I had a 30-40 mile commute to work each day, I could probably benefit from Snapshot. But since most of my driving is around town (with LOTS of traffic), it didn’t really work for me.

What’s really neat about the Snapshot program is that you get weekly e-mail updates showing you your driving stats. If it says you’re braking hard too often, you can adjust your driving habits to make Snapshot happy.

Overall, it’s a cool program that rewards good drivers, and if you’re looking to knock down your car insurance rates, I’d definitely recommend checking it out!

Visit http://www.progressive.com/auto/snapshot/ for more information.

Content and/or other value provided by our partner, Progressive.

James Shaffer

January 29, 2014 at 5:28 pm

I don’t understand this snapshot thing. First, why wouldn’t your accident record be a better predictor of claims? If your drive 30K miles annually and have no accidents, would’nt you deserve a better rate than a driver doing 5K miles/year and a few fender benders?

Second, why would you possibly want to give the insurance any more information than they already have to deny claims? I think there is a good rationale to question the requirement for insurance by state and whether you can move to a self insure model if you so choose. Insurance companies have progressively moved to force insured’s to view insurance only for catastrophic circumstances.

Aaron

January 30, 2014 at 4:17 pm

You only use the Snapshot for about 45 days before they ask you to return it. They are mostly getting driving patterns and risk behavior from it. It’s not a “black box” for wrecks.

We had one after switching from the lizard and Progressive told us that we had over-estimated our average driving (thus cutting our price) and were both excellent drivers with few flags thrown by the device while we had it. Since most of our driving is on the freeway at speed (traffic here doesn’t really exist) and we are only putting about 5,500 miles per year on our car, our rate is tiny compared to what we paid before.

It’s worth a try and if it doesn’t help your rate, you can always go elsewhere. Heck, do like we did and get one while you’re still on someone else’s insurance and see if it will save you anything.